For decades, Pakistan’s control of key transit routes into Afghanistan enabled Islamabad to exert disproportionate political influence over its landlocked neighbour. Periodic border closures, justified on security grounds, often disrupted Afghan trade and triggered substantial economic losses. Yet in late 2025, this longstanding asymmetry shifted in a manner few in Islamabad expected.

Beginning on 9 October 2025, Pakistan suspended all Afghan transit and commercial routes. By 11 October, the freeze had widened to every major crossing point. Historically, such actions have severely constrained Afghanistan’s imports, particularly food staples, construction materials, and pharmaceuticals. This time, however, Kabul responded with an unprecedented political and economic counter-measure—one that has fundamentally altered the dynamics of regional trade.

A New Afghan Posture: Strategic Diversification Over Dependence

On 12 November, Afghanistan’s Deputy Prime Minister for Economic Affairs, Mullah Abdul Ghani Baradar, articulated what can only be described as a strategic reset in Afghan trade policy. In a televised statement, he urged Afghan businesses to “turn to alternative trade routes” and reduce structural reliance on Pakistan. His message was clear: Afghanistan no longer accepts trade as an instrument of political pressure.

Baradar’s remarks reflected deep frustration with Pakistan’s longstanding practice of keeping border crossings selectively open. Afghan agricultural exports—particularly perishable fruit—have often spoiled during prolonged delays at the border. Kabul also cited the significant outflow of foreign currency to Pakistan’s pharmaceutical sector, with Afghan officials estimating hundreds of millions of dollars annually spent on low-quality imports.

The Three-Month Deadline

Baradar announced a decisive policy shift:

- Afghan companies must settle accounts and contracts inside Pakistan within three months.

- Afghanistan would gradually restrict—and ultimately ban—Pakistani pharmaceutical imports.

- Kabul would not reopen routes without credible, enforceable guarantees against future political closures.

The statement marked the first time Afghanistan conditioned access to its market on structural assurances from Islamabad.

Economic Repercussions Inside Pakistan

Pakistan initially attempted to keep price increases out of public discourse, but reporting from Reuters, the BBC, and independent journalists quickly documented the impact:

- Tomato prices rose fivefold,

- Other imported essentials saw steep increases,

- Export goods destined for Central Asia lost value due to disrupted transit.

Pakistan’s Foreign Ministry defended the closures on security grounds, arguing that protecting Pakistani lives must take precedence. But for many Pakistanis—already grappling with inflation, unemployment, and a deteriorating fiscal climate—the explanation resonated weakly.

Furthermore, Islamabad had assumed Kabul would eventually seek accommodation. Instead, Pakistan found itself confronting a neighbour that had prepared alternatives months in advance.

Afghanistan’s Rapid Trade Diversification

Contrary to official narratives within Pakistan, Afghanistan did not experience the catastrophic disruption many predicted. Instead, Afghan trade was swiftly reorganised through multiple corridors.

Before October 2025

- Pakistan-Afghanistan bilateral trade (2024): US$1.4 billion

- Iran-Afghanistan trade (2024): US$1.6 billion,

making Iran—not Pakistan—Kabul’s largest trading partner.

After the October Closure

- Afghan imports from Pakistan:

- US$247m in October 2024

- US$114m in October 2025

- US$0 in November 2025

Pakistan’s export earnings collapsed overnight.

Pivot to the North and West

In November alone:

- Afghan produce destined for Pakistan was redirected toward Uzbekistan and Russia.

- The Afghanistan–Uzbekistan–Iran trade corridor was activated.

- A trilateral Chamber of Commerce was established.

- The Imam Abu Hanifa Exhibition concluded with US$700 million in new contracts.

Meanwhile, Afghanistan’s Commerce Minister, Nooruddin Azizi, held a five-day visit to India, expanding access to South Asian markets. Agreements included:

- Regular Amritsar–Kabul cargo flights,

- Expanded trade in cement, pharmaceuticals, and food items,

- Collaborative frameworks in Afghanistan’s health sector.

Afghanistan also formalised new cement imports from Iran, replacing Pakistan’s supplies, and re-routed coal exports toward Central Asia.

International Data Validates the Policy Shift

The World Bank’s Afghanistan Economic Monitor (October 2025) reported:

- Afghan exports rose to US$267 million,

- A 3.7% increase from the previous year,

- And a 13% month-on-month rise despite Pakistan’s closures.

The report attributed this resilience to improved access to Indian and Central Asian markets.

Meanwhile, the IMF’s Governance Diagnostic Report on Pakistan painted a stark picture:

“Corruption is a widespread and persistent feature of governance in Pakistan. It has not improved in 20 years and continues to hinder economic and social development.”

Pakistan remains heavily indebted, having borrowed US$22.8 billion from the IMF since 2008.

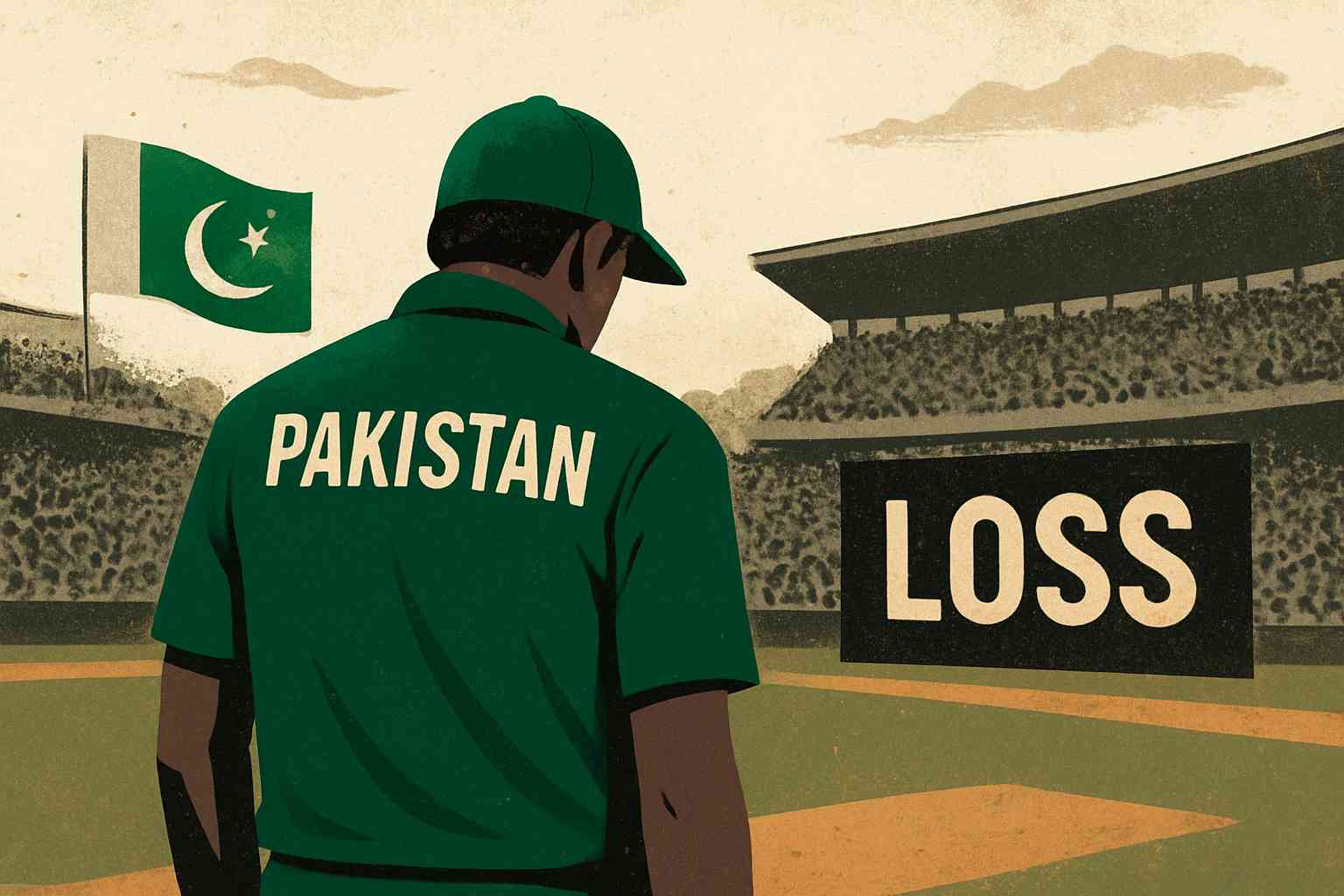

An Economic and Geopolitical Turning Point

Pakistan’s trade with Central Asia and Azerbaijan reached US$2.41 billion in FY25, of which US$1.77 billion were exports routed through Afghanistan. Much of this is now at risk.

Islamabad’s attempts to pressure Kabul have resulted in:

- Loss of regional market access,

- Loss of export revenues,

- Weakening of Islamabad’s traditional transit leverage,

- Increased Afghan economic independence,

- Strengthened Afghan ties with India, Iran, and Central Asia.

Meanwhile, Pakistan’s remaining transit connections are limited to:

Iran

Tehran openly prioritises its trade relationship with Afghanistan.

China

Beijing has expressed frustration with Pakistan’s growing security alignment with the United States and the slow pace of trade facilitation under CPEC.

In effect, Pakistan’s unilateral closures accelerated Afghanistan’s long-term strategy of diversification—reducing Kabul’s vulnerability while increasing Islamabad’s isolation.

Conclusion: A Reversal of Roles in the Region

For the first time in modern history, Afghanistan has structurally reduced its economic dependence on Pakistan. Kabul now enjoys multiple regional trade options, diversified markets, and growing autonomy. International financial indicators show resilience in Afghan exports and confidence among regional partners.

Pakistan, by contrast, faces:

- Shrinking export markets,

- Diminished leverage over Afghanistan,

- Rising domestic prices,

- Weakening regional influence,

- And intensified scrutiny from international financial institutions.

The strategic calculus has shifted. Afghanistan has emerged from this episode not weakened but more sovereign, diversified, and economically agile. Pakistan is left confronting the unintended consequences of its own policy choices—isolated economically, constrained diplomatically, and increasingly reliant on limited regional corridors.

The era in which Pakistan could dictate terms through border closures may now be over. Afghanistan’s new trade posture signals a rebalanced regional landscape—one where coercive economic tools are far less effective, and long-standing assumptions about dependency no longer hold.

Adil Raja is a retired major of the Pakistan Army, freelance investigative journalist, and dissident based in London, United Kingdom. He is the host of “Soldier Speaks Reloaded,” an independent commentary platform focused on South Asian politics and security affairs. Adil is also a member of the National Union of Journalists (UK) and the International Human Rights Foundation. Read more about Adil Raja.. Read more about Adil Raja.